Tds deduction on salary calculation

Factors Affecting The Salary Calculation Formula. Standard deduction 50000.

Pf Deduction Pay Head For Employees Payroll In Tally Erp 9 Data Migration Deduction Data

The exempted monetary amount can be received as the refund of the excess TDS.

. Salary calculation formulas depend on several factors such as. Your company jointly deposits an equal amount to your EPF and pension fund. The hassles associated with reconciliation and TDS deduction is minimized significantly.

HRA calculation can be done annually in case the deciding factors remain constant. If TDS has been deducted by your employer and you fulfill the criteria for. Facilitates Calculation of Annual Salary after Giving an Effect of Deduction under Chapter VI-A along with Calculation of Month-wise Salary and TDS thereonn.

Note TDS is deducted every month from your salary. This component is available as a deduction under Income Tax Act 1961 US 80C. 25 lakh under TDS Challan.

Deduction under Section 80C ELSS EPF. Salary and all other positive incomes under any head on income Section 192. Facilitates Preparation and E-filing of the Returns 24Q 26Q 27Q 27EQ with Proper Validations along with Declaration of Non-filing in Case of No TDS Deduction.

The employee and the employer each contribute 12 of the employees base salary to the EPF employee provident fund each month. Same is calculation only basic salary not taking into account DAWhy. This article is based on Calculation Salary Calculation salary.

At the time of giving credit to the party or actual payment of the dues. Group insurance policy premiums. The contribution paid by the employee to the EPF is deductible under Section 80C of the Income Tax.

Meaning Components Calculation September 17 2021 6 Mins Read. The rate of deduction is based on the status of the entity that receives the payment or provides the service. 25 lakh on total income You must pay 5 of Rs.

This is what it looks like. Provisions for TDS when renting an NRI property. Income from other sources 10000.

Other deductions such as deductions under section 80C 80CCC 80CCD 80CCG 80D 80DD 80DDB 80E 80EE etc. Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. Note your monthly income and multiply it by 12 to find your yearly income.

Tenants paying rent on properties owned by NRIs are required to deduct 312 tax at source and. In order to understand the TDS deduction on salary for Mohan we need to see the income tax slab that he belongs to. New Section 194S-A person is liable for Tax Deduction at Source TDS at 1 at the time of payment of the transfer of virtual digital assetsSale of immovable property under Section 194-IA-It is proposed to amend the amount on which TDS should be deductedThe person buying the property should deduct tax at 1 on.

In ex-4 10 of salary plus DA is calculating for HRA. Your expected TDS liability for a year is divided by 12 which is. TDS or Tax Deducted at Source.

Union Budget 2022 updates. Net salary 12 lakh. Budget 2017 changed the rules for tax deduction at source on rent paid in India.

Gross Salary 15 lakh. HRA If the employee lives in a rented facility and is paying rent towards accommodation then it will be allowed for House Rent allowance deduction. Net Taxable Income Rs.

Monetary limit for TDS applicability should be considered while determining TDS liability. Consider tax treaties before determining the rate of withholding tax under Section 195. Should be considered before the calculation of tax on salary.

Minimum salary one should have for. Deduction of allowances under Section 10A of IT Act. The calculation of TDS always considers the threshold and the exception threshold that are defined for the TDS component.

The basic salary is the base income of the fixed component of the whole compensation offered to employees. TDS provident fund etc. In computation of TDS I cant understand the deduction of HRA 10 excess of rent paidbetween the examples no 4 and example no-6.

Items Eligible for TDS Exemption. Below mentioned is the given format for calculation of TDS on Salary. Gross Salary Simplified.

Salary refers to the sum of basic salary dearness allowance DA and any other commissions if applicable for the purpose of HRA calculation. Employee contribution to the provident fund. 40 of salary when residential house is situated elsewhere.

Here are six easy steps for you to calculate the TDS on salary. Interest calculation on Late Deduction of TDS If tax was deductible on 12th April ie. All TDS Rates for Non-Salary payments have been cut by 25 upto 31st March 2021.

It is very simple to do the TDS calculation on salary. HRA and LTA 25 lakh. Gross taxable income 1210000.

In case any factor changes. The upper ceiling is 25 which means that rent paid in between 10 and 25 of the salaryincome is only available for deduction HRA exemption. That is if the normal rate of TDS is 10 now TDS is to be done at 10 - 25 75.

Maximum Deduction Rs 300000 is allowed for retirement contributions like PF and CIT but such a limit is increased to 500000 in case of staff registered in SSFsocial security tax for Salary TDS calculation 2076-77 as per income tax Nepal. Age 40 years. 25 lakh Tax exemption up to Rs.

50 of salary when residential house is situated in Mumbai Delhi Chennai or Kolkata. Total income Rs5lakh.

Gst Collections Expected To Be 30 Lower At Rs 9 Lakh Crore In Fy21 Goods And Service Tax Goods And Services Indirect Tax

Download Salary Sheet With Attendance Register In Single Excel Template Exceldatapro Attendance Register Salary Attendance

Creating Pay Head For Income Tax Deduction Payroll In Tally Erp 9 Tax Deductions Income Tax Voucher

Spinetechnologies Com Payroll Software Hrms Payroll

Tds In Tally Prime Tds Entry In Tally Prime Tds In Tally Erp 9 Tds In Tally Development Entry Power

Income Tax Calculator Python Income Tax Income Tax

Sag Infotech Gen Desktop Payroll Software For Hr Professionals Payroll Software Employee Management Payroll

Checklist Of Documents For Filing Income Tax Return Tax Checklist Income Tax Accounting Training

Payroll Hr Ppt Slides Powerpoint Templates Powerpoint Hr Management

67rw04bntrckmm

Latest Gst And Income Tax Compliance Calendar For May 2022 In 2022 Tax Software Income Tax Compliance

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

Tds On Sale Of Immovable Property Section 194 Ia Form 26qb Tax Deducted At Source Sale Property

File Manager In Eztax In App Filing Taxes Income Tax Self

E Kyc Portal Of Epf Link Uan With Aadhaar Without Employer Employment Portal One Time Password

Prealgebra Activities Real Number System Maze Activities The First Unit Of The Year Is Always The Mo Real Number System Real Numbers Pre Algebra Activities

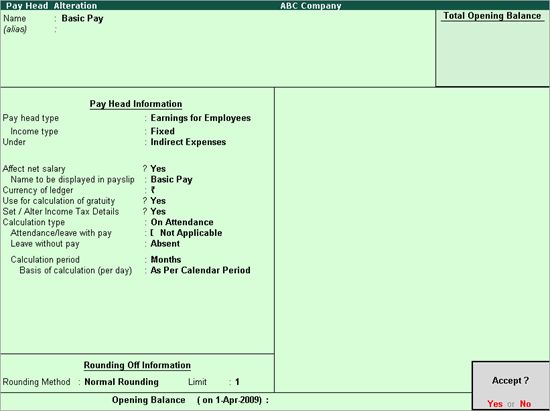

Creating Earnings Pay Head Payroll In Tally Erp 9 Voucher Tutorial Data Migration